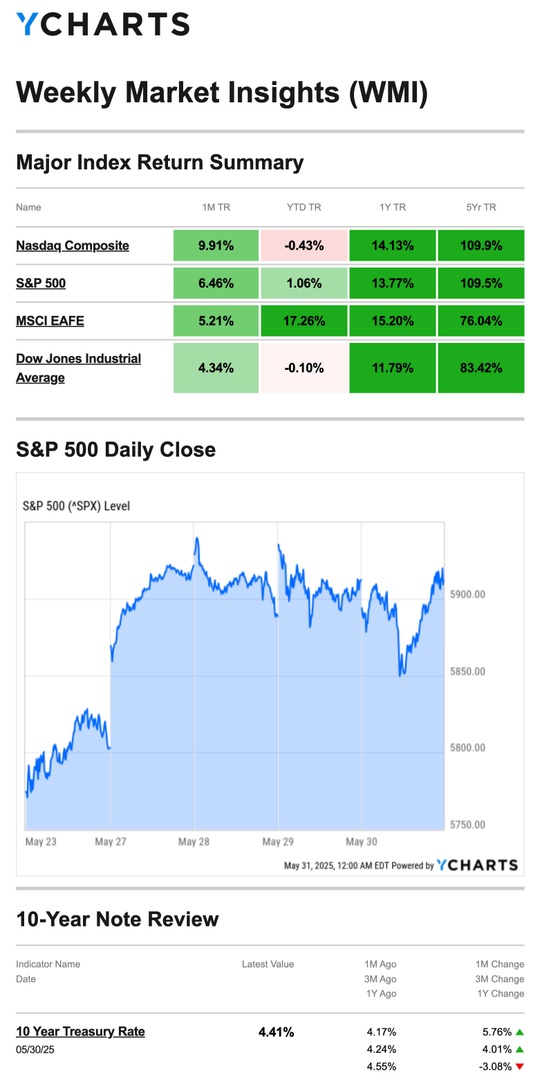

Stocks advanced over the short trading week, bolstered by a possible trade deal with the European Union (EU) and an upbeat corporate report from a mega-cap tech company that creates semiconductors used in the creation of artificial intelligence.

The Standard & Poor’s 500 Index rose 1.87 percent, while the Nasdaq Composite Index popped 2.01 percent. The Dow Jones Industrial Average advanced 1.60 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, inched up 0.84 percent.1,2

EU Trades Spark Stocks

On Monday, stocks bolted out of the gate on news that the European Union agreed to speed up trade talks with the U.S. By the end of the session, the S&P 500 and Nasdaq posted gains north of 2 percent.3

Stocks fell following Wednesday’s release of minutes from the Fed meeting in May, which showed Fed officials are cautious. Some fear that trade-related economic uncertainty could increase inflation and impact the labor market.4,5

On Friday, stocks were flat despite the White House accusing China of violating its trade deal. The S&P 500 added 6.2 percent and the Nasdaq 9.6 percent for the month, their best since November 2023.6

Source: YCharts.com, May 31, 2025. Weekly performance is measured from Friday, May 23, to Friday, May 30. TR = total return for the index, which includes any dividends as well as any other cash distributions during the period. Treasury note yield is expressed in basis points.

Inflation Update

The Fed’s preferred inflation measure—the Personal Consumption and Expenditures (PCE) Index—was released on Friday, showing only a modest uptick in prices in April.7

PCE increased 0.1 percent for the month, putting the annual rate at 2.1 percent—the lowest since September 2024.

On the Expenditures side, the report shows a higher consumer saving rate as they navigate economic uncertainty.8

This Week: Key Economic Data

Monday: ISM Manufacturing. Construction Spending. Dallas Fed President Lorie Logan speaks.

Tuesday: Factory Orders. Job Openings.

Wednesday: ADP Employment Report. ISM Services. Fed Beige Book.

Thursday: Trade Deficit. Productivity Gains.

Friday: Employment Report. Consumer Credit.

Source: Investors Business Daily – Econoday economic calendar; May 30, 2025

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Tuesday: CrowdStrike (CRWD), Hewlett Packard Enterprise Company (HPE)

Thursday: Broadcom Inc. (AVGO)

Source: Zacks, May 30, 2025. Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

“Experience is a dear teacher, but fools will learn at no other.”

– Benjamin Franklin

Received A Letter From the IRS? Here’s What to Do

The IRS mails letters or notices to taxpayers for a variety of reasons, including:

- You have a balance due

- You are due a larger or smaller refund

- The IRS has a question about their tax return

- You must verify your identity

- The IRS requires additional information

- The IRS changed their tax return

If you receive a letter or notice from the IRS, check for any action items. If something needs attention, the IRS may provide a deadline for a response. You should also keep a copy of the letter for your tax records. Remember, all official IRS correspondence is through the mail, so there is usually no need to call the IRS.

This information is not a substitute for individualized tax advice. Please discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS9

Combat “Text Neck” With These Two Stretches

From texting to emailing to browsing the internet and social media, we spend hours and hours every day on our phones, which can cause pain in our back and neck.

Have a tight neck? These two stretches can help!

The exaggerated nod—This stretch seems simple but is very effective. Sit comfortably, and with your teeth touching but not clenched, lean your head back like you are looking up at the ceiling. Then, gently open and close your mouth. You should feel a stretch both in the back of your neck and in the front.

Touch your toes—This stretch addresses both your hamstrings and your neck. Stand with your feet shoulder-width apart and hinge at your hips while reaching down to touch your toes. Relax your neck. If you can’t touch your toes, that’s ok! Enjoy the stretch along your back.

Tip adapted from Healthline10

When I change my jacket, I make a loud noise and become larger but weigh less. What am I?

Last week’s riddle: It has dozens of fine teeth, but you can hold it in your hand, and it will never bite you. What is it?

Answer: A comb

Al Fatih Grand Mosque

Manama, Bahrain

Footnotes and Sources

1. WSJ.com, May 30, 2025

2. Investing.com, May 30, 2025

3. WSJ.com, May 27, 2025

4. CNBC.com, May 28, 2025

5. CNBC.com, May 29, 2025

6. WSJ.com, May 30, 2025

7. MarketWatch.com, May 30, 2025

8. MarketWatch.com, May 30, 2025

9. IRS.gov, October 7, 2024

10. Healthline, December 12, 2024