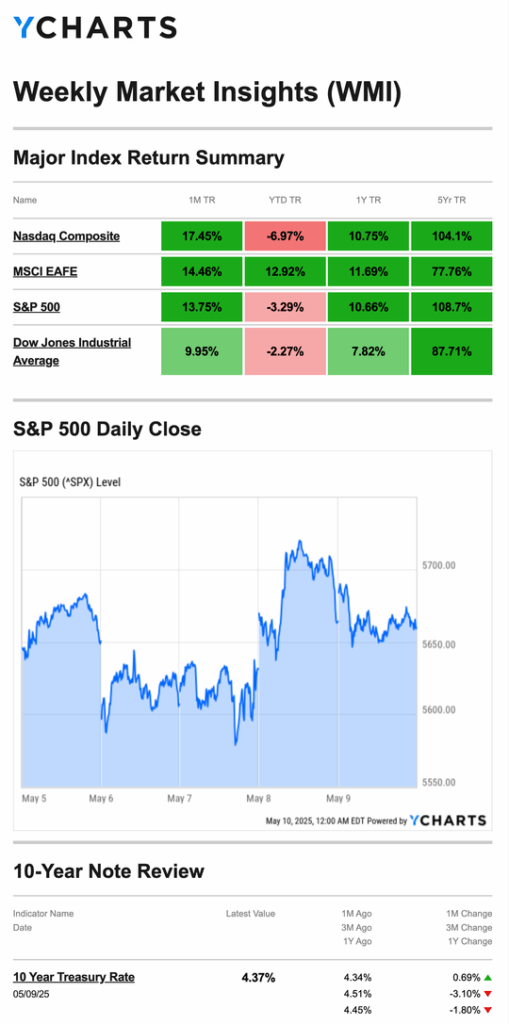

Stocks were lower last week as volatility dropped despite ongoing trade concerns and the Federal Reserve’s update on short-term rates

The Dow Jones Industrial Average dropped 0.16 percent, while the Standard & Poor’s 500 Index lost 0.47 percent. The tech-heavy Nasdaq Composite Index slipped 0.27 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, fell 0.37 percent.1,2

Stocks Go Sideways

Stocks dropped on Monday, ending the S&P 500’s 9-day winning streak as the trade anxiety weighed on investors.3,4

Sentiment picked up midweek, however. In a widely expected move, the Fed held short-term interest rates steady but warned of lingering uncertainty around tariffs’ effects on inflation and unemployment.5,6

On Thursday, the U.S.-U.K. trade deal sparked a slight rally, but stocks flattened as the week ended. Investors appeared to be risk-averse with U.S.-China trade talks scheduled for the weekend.7

Source: YCharts.com, May 10, 2025. Weekly performance is measured from Monday, May 5, to Friday, May 9. TR = total return for the index, which includes any dividends as well as any other cash distributions during the period. Treasury note yield is expressed in basis points.

The Fed Fans Out

The Federal Reserve wanted to get its message out last week. Within 48 hours of the Fed’s decision to leave interest rates unchanged, nearly every Fed governor gave a solo speech or discussed the decision on a panel.

One Fed official spoke about the benefits of long-term stability from an independent Fed. At the same time, another said the Fed was paying close attention to what consumers did—and not just what they said, suggesting that flagging consumer sentiment didn’t necessarily mean a slowdown in spending.7

The Fed seemed to focus on managing expectations. Perhaps more importantly, Fed officials spoke from a coordinated playbook, possibly designed to help settle financial markets.

This Week: Key Economic Data

Monday: Federal Budget.

Tuesday: Consumer Price Index (CPI). NFIB Small Business Optimism Index.

Wednesday: San Francisco Fed President Mary Daly speaks.

Thursday: Retail Sales. Jobless Claims (weekly). Producer Price Index (PPI). Industrial Production. Business Inventories. Home Builder Confidence Index.

Friday: Import Price Index. Housing Starts. Building Permits. Consumer Sentiment.

Source: Investors Business Daily – Econoday economic calendar; May 9, 2025

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Wednesday: Cisco Systems, Inc. (CSCO)

Thursday: Walmart Inc. (WMT), Deere & Company (DE), Applied Materials, Inc. (AMAT), NetEase, Inc. (NTES)

Source: Zacks, May 9, 2025. Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

“Innovation is saying ‘no’ to 1,000 things.”

– Steve Jobs

Don’t Forget to Take Advantage of the Work Opportunity Tax Credit

The work opportunity tax credit is a federal tax credit for business owners who have hired individuals from target groups that would have otherwise faced significant barriers when looking for a job. Some target groups include summer youth employees, those receiving Supplemental Security Income, or qualified long-term unemployment recipients. There are ten targeted groups in total.

The work opportunity tax credit equals 40% of up to $6,000 in wages paid or incurred, with a maximum credit of $2,400. The WOTC may consider up to $24,000 in wages for certain qualified veteran-targeted groups. The restrictions are on the IRS website.

This information is not a substitute for individualized tax advice. Please discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS8

Stay Safe This Summer With These Open Water Safety Tips

Summer is the perfect time to spend at the beach, lake, or river. But unfortunately, these natural bodies of water can also be hazardous if you don’t know how to stay safe. Here are some tips to help you and your family stay safe in the water this summer:

- Only swim in the designated swimming area. Take note of flags and buoys that mark where you can and can’t swim.

- When in doubt, get out! If something doesn’t feel suitable, such as a current picking up, it’s better to use caution and get out.

- Know the conditions before you swim. The more you know about water levels, temperature, and current, the better.

- Never swim alone when in open water. Always swim with a buddy who can look out for you, and you can look out for them.

Tip adapted from National Drowning Prevention Alliance9

What always shows up in the middle of March and the middle of April?

Last week’s riddle: A word appears, and six letters it contains. Subtract only one, then twelve remains. What is this word?

Answer: Dozens.

Golden Temple

Laojunshan, Luoyang, China

Footnotes and Sources

1. The Wall Street Journal, May 9, 2025

2. Investing.com, May 9, 2025

3. CNBC.com, May 5, 2025

4. CNBC.com, May 6, 2025

5. The Wall Street Journal, May 7, 2025

6. CNBC.com, May 8, 2025

7. The Wall Street Journal, May 9, 2025

8. IRS.gov, November 11, 2024

9. NDPA.org, December 12, 2024