Much has been written lately about the threats facing the reserve currency status enjoyed by the U.S. dollar. “De-dollarization” headlines appear on a near-daily basis, suggesting the dollar’s reign is in looming jeopardy, while counter arguments point out there isn’t another currency with the depth, transparency, and reliability associated with the dollar. Still, critics accuse the U.S. of having “weaponized” the dollar, that is, punishing other countries with sanctions and freezing assets. These accusations have been particularly prevalent as the Ukraine/Russia conflict continues, with Russia and its long-standing allies asserting that the U.S. has illegally frozen billions of dollars of Russian financial assets.

In addition, China has been increasingly active on the world stage as it seeks to elevate the yuan as a reserve currency and dent the hegemony of the dollar’s rule in global trade and overall standing.

Affecting the dollar currently, in economic terms, is that the Federal Reserve (Fed) is near, or at the end of its aggressive rate hike campaign that began in March 2022, and accordingly, the dollar has been edging lower against the basket of currencies of its largest trading partners. As a result, the dollar has been losing the “interest rate differential” that propelled the dollar to an almost parabolic high for much of 2022, while the euro has gained strength as the European Central Bank (ECB) continues to raise interest rates.

The Dollar Within The Global framework

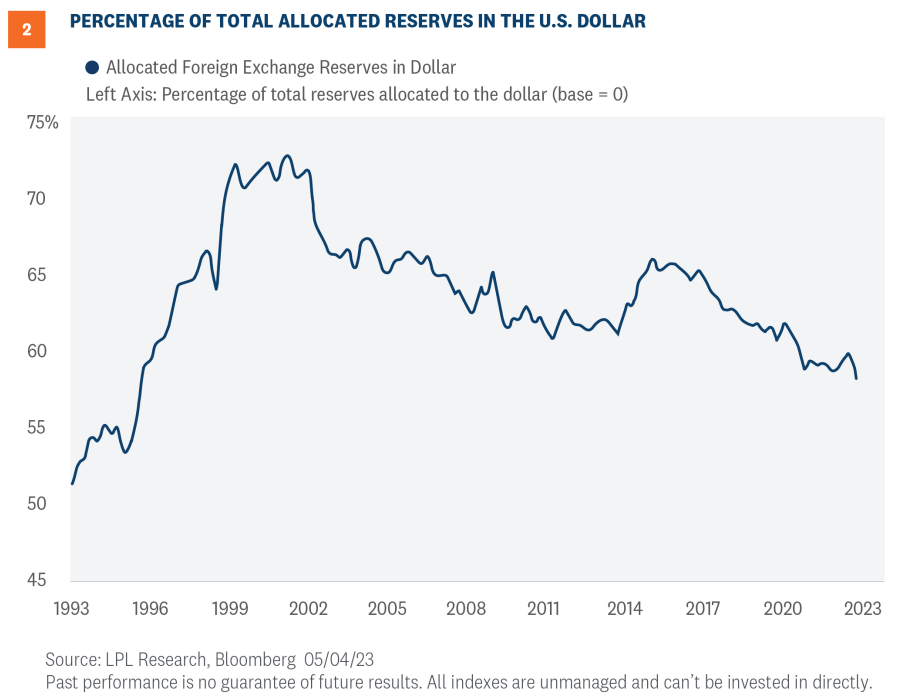

The dollar, thanks in large part to its liquidity and reliability, is used as the primary currency of choice by the majority of global central banks that keep a good portion of their reserves in dollars. To be sure, central banks have been heavy purchasers of gold as concerns build over the ramifications of de-globalization and what has been viewed as “fragmentation” as new trading blocs are discussed and being formed.

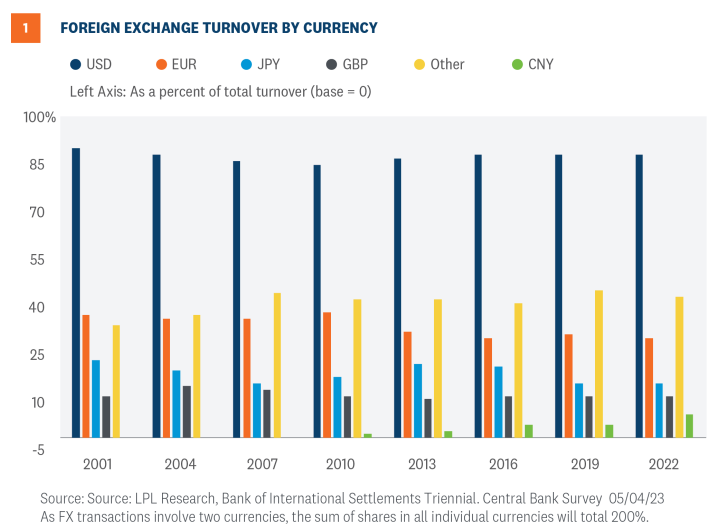

Foreign companies still borrow in dollars and use the dollar in their normal trading operations, with the dollar the leading currency in global trade invoicing and settlements.

Part of the criticism leveled at the U.S. is that the ubiquitous use of the dollar has allowed the U.S. to run an unfairly large trade deficit, at the expense of trading partners. While the U.S trade deficit was $64.2 billion in March, and is the largest trade deficit globally, the United Kingdom, Mexico, and Brazil also run large deficits.

China Stages a Push to Legitimize the Yuan Towards Reserve Status

Of all of the reporting regarding threats against the dollar’s dominance within the global financial infrastructure, China’s drive towards increasing acceptance of the yuan as a reserve currency carries the most relevancy. As the world’s second largest economy, it has for many decades had important trade relationships priced in the yuan, or renminbi, the official name forits currency.

Many companies have been using the yuan for decades, as trade with China is an integral part of their global market footprint.

In 2016, the International Monetary Fund (IMF) added the renminbi into its Special Drawing Rights (SDR) basket following years of intense lobbying by China. Established in 1969, the IMF considers the SDR as a “supplementary international reserve asset”. The SDR now includes the U.S. dollar, the euro, the British pound sterling, the Japanese yen, and the Chinese renminbi.

The debate over China’s entry into the SDR centered on its status as an emerging market and concerns over its human rights record. Still, the IMF board voted to allow the renminbi to join the group of developed market currencies, affording its currency a legitimacy of sorts.

China’s President Xi Jinping has been behind an intense effort to secure trade agreements globally, and the results have been successful in terms of global reach, including Russia and Saudi Arabia. Within Europe, China has a long-established relationship with Italy, and is carving out deeper bilateral ties with France. Brazil has also been an active trading partner with China. Russia strengthened its relationship with China when it was banned from using SWIFT, the global financial transaction processing system.

But the outreach is also tinged with an anti-U.S. posture, as tensions between the U.S. and China escalate on many fronts, particularly over Taiwan. The “weaponized dollar” theme has been playing well as China’s stepped up bilateral efforts gain momentum.

Chinese officials point to the sanctions imposed on Russia as an example of how the U.S. has weaponized the dollar, which certainly extrapolates easily to what a U.S.-led effort could do against Chinese assets in the event of a forced takeover of Taiwan. It’s been evident that China has been transitioning away from the dollar as the People’s Bank of China has been a major buyer of gold as it increases its stockpiles. It is estimated the central bank now has 2,068 tons in its gold reserve.

King Dollar Still Reigns

The euro has, since its inception in 1999, become an important global reserve currency in terms of its use in global trade, however, because of its fragmented political and economic structure, its rise towards a more complete reserve status is thwarted. That the yuan is rising in its acceptance by trading partners is apparent, but to be recognized as an authentic reserve currency requires transparency, reliability, and credibility.

The dollar’s backing is exemplified by a sound foundation, a history of credibility, and transparency that cannot be negated by its detractors. King dollar still reigns and will for the foreseeable future.

Investment Outlook

LPL Research remains comfortable with its year-end S&P 500 fair value target of 4,300–4,400, based on price-to-earnings ratio of 18 and $240 in S&P 500 earnings per share in 2024. But as stocks get closer to that target, LPL Research’s Strategic and Tactical Asset Allocation Committee (STAAC) may reconsider its recommended slight overweight allocation to equities. The year-end forecast range for the 10-year Treasury yield remains 3.25% to 3.75%.

The Committee notes that the outlook for growth stocks has improved, suggesting balanced style exposure, while the outlook for small caps has become more challenging in recent weeks, as credit conditions have tightened amid ongoing small bank stress, supporting an overweight large cap stance. The STAAC has upgraded its view of international equities to overweight on attractive valuations and improved technical analysis trends, while the potential for U.S. dollar weakness in the intermediate term is a potential catalyst. Industrials remain the Committee’s top sector pick.

Within fixed income, the Committee recommends an up-in-quality approach with a benchmark weight to duration. We think core bond sectors (U.S. Treasuries, Agency mortgage-backed securities (MBS), and short maturity investment grade corporates) are currently more attractive than plus sectors (high-yield bonds and non-U.S. sectors) with the exception of preferred securities, which look attractive after having recently sold off due to the banking stresses.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

US Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with lower PE ratio.

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability. Earnings per share is generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-to-earnings valuation ratio.

All index data from FactSet.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

Asset allocation does not ensure a profit or protect against a loss.

A CDS contract is a derivative product that protects the CDS buyer from a credit default of the underlying security. Credit risk is transferred to the seller of the CDS contract, who requires a premium for the protection. As credit risk increases or decreases, the contract premium goes up and down, similar to an insurance policy.

A typical notional on a CDS is in the range $10-$20 mm. CDSs have a stated maturity (typical terms are 3, 5, 7, and 10 years), with the most liquid point at 5 years. Typically, credit default swaps are the domain of institutional investors.

Preferred stock dividends are paid at the discretion of the issuing company. Preferred stocks are subject to interest rate and credit risk. As interest rates rise, the price of the preferred falls (and vice versa). They may be subject to a call feature with changing interest rates or credit ratings.

The fast price swings in commodities will result in significant volatility in an investor’s holdings. Commodities include increased risks, such as political, economic, and currency instability, and may not be suitable for all investors.

Value investments can perform differently from the market as a whole. They can remain undervalued by the market for long periods of time.

The prices of small cap stocks are generally more volatile than large cap stocks.

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

This research material has been prepared by LPL Financial LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Guaranteed | Not Bank/Credit Union Deposits or Obligations | May Lose Value

RES-1513785-0423 | For Public Use | Tracking # 1-05369666 (Exp. 05/2024)