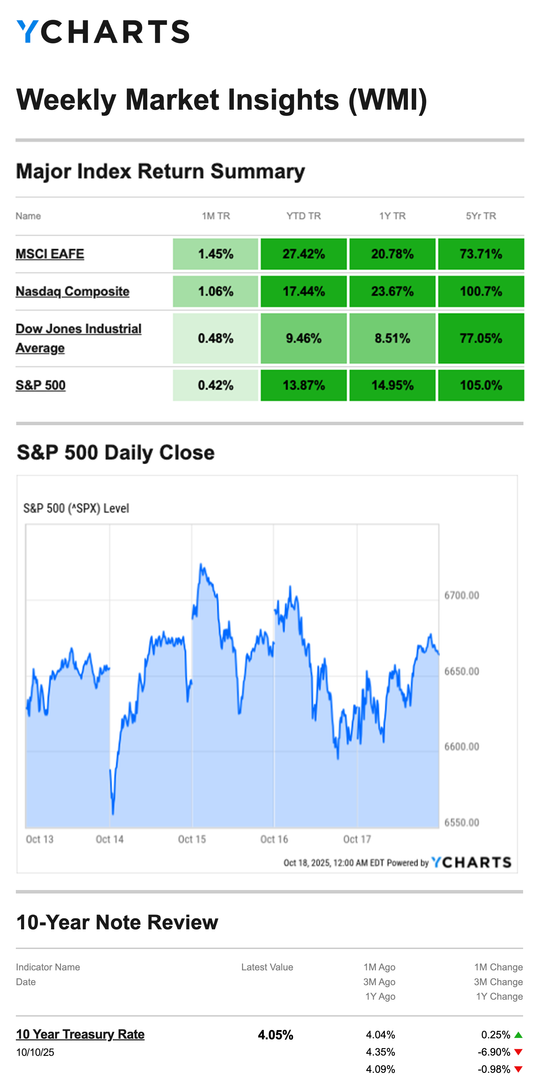

Stocks pushed higher last week, buoyed by strong third-quarter results posted by several money center banks.

The Standard & Poor’s 500 Index gained 1.70 percent, while the Nasdaq Composite Index rose 2.14 percent. The Dow Jones Industrial Average advanced 1.56 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, added 0.74 percent.1,2

A Bumpy Week

Stocks rose to start the week after the White House shifted tone over the weekend on trade relations with China. Gains were broad-based—4 out of 5 stocks in the S&P 500 rose—with the index posting its best day since May 27.3

Overnight, the specter of a revived trade war with China reemerged after the country placed sanctions on U.S. subsidiaries of South Korean shipbuilders in an apparent effort to increase its control over global shipping. Stocks opened sharply lower the next morning, and then quickly staged an impressive rebound—helped by mostly positive quarterly earnings results from a handful of big money center banks.4

Stocks rose again midweek as better-than-expected Q3 corporate results from the biggest banks continued to roll in, overpowering negative sentiment around lingering trade concerns. As the week wrapped, bank stocks and all three broad market averages pushed through jitters to end in the green.5,6,7

Source: YCharts.com, October 18, 2025. Weekly performance is measured from Monday, October 13 to Friday, October 17. TR = total return for the index, which includes any dividends as well as any other cash distributions during the period. Treasury note yield is expressed in basis points.

Bank Stock Paradox

While trade tensions with China dominated the attention during the week, some bank news also captured investor interest.

Last week, several money center banks reported expectation-beating Q3 results, underscoring the narrative of a healthy economy and robust consumer spending.

But there was a flip side to the banking sector: a smaller regional bank reported a $50 million credit loss from two commercial loans. The loss also hit larger banks with a stake in the loss. The news rattled the markets. For investors, it evoked memories of two regional bank failures in 2023, raised questions about whether this was a broader systemic issue, and put pressure on bank stocks, both big and small.8

This Week: Key Economic Data

Monday: Leading Economic Indicators.

Tuesday: Fed governor Christopher Waller speaks.

Wednesday: Atlanta Fed Business Inflation Expectations. 20-Year U.S. Treasury Bond Auction.

Thursday: Weekly Jobless Claims. Existing Home Sales. Fed Balance Sheet.

Friday: Consumer Price Index (CPI). New Home Sales. PMI Composite–Services. PMI Composite–Manufacturing. Consumer Sentiment.

Source: Investors Business Daily – Econoday economic calendar; October 17, 2025. The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Tuesday: Netflix, Inc. (NFLX), GE Aerospace (GE), The Coca-Cola Company (KO), Philip Morris International Inc. (PM), RTX Corporation (RTX), Texas Instruments Incorporated (TXN), Danaher Corporation (DHR), Capital One Financial Corporation (COF), Lockheed Martin Corporation (LMT)

Wednesday: Tesla, Inc. (TSLA), International Business Machines Corporation (IBM), Thermo Fisher Scientific Inc. (TMO), AT&T Inc. (T), Lam Research Corporation (LRCX), GE Vernova Inc. (GEV), Boston Scientific Corporation (BSX), CME Group Inc. (CME)

Thursday: T-Mobile US, Inc. (TMUS), Intel Corporation (INTC), Union Pacific Corporation (UNP), Honeywell International Inc. (HON), The Blackstone Group (BX), Newmont Corporation (NEM)

Friday: The Proctor & Gamble Company (PG), HCA Healthcare, Inc. (HCA)

Source: Zacks, October 17, 2025. Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

“I didn’t know that I was different and now I realize how very different I was. But difference is what makes the world beautiful.”

– Venus Williams

Tax Benefits for Charitable Giving

Giving back to others feels good and is a great way to support your community and those in need, but it also may have tax advantages. According to the IRS, most charitable contributions, including cash and property contributions, are deductible as an itemized deduction when you file your taxes.

Some contributions aren’t tax-deductible, so check the current tax law or talk to your accountant before deducting charitable gifts from your tax return. You can even use the Interactive Tax Assistant on the IRS website to see if your charitable contribution is deductible.

This information is not a substitute for individualized tax advice. Please discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS9

Goals That Stick

Remember, your goals should be specific, measurable, actionable, realistic, and timely. Here are some to get you started:

- Eat more whole foods (set a particular number based on your lifestyle)

- Drink more water (put a specific number of ounces you want to hit)

- Sit less and move more (ex: standing up once per hour for 12 hours)

- Go for a 15-minute walk every day

- Get at least 7 hours of sleep

We’d love to know: what goals are you setting?

Tip adapted from Healthline10

Fill in the blank: if Ruby’s mom is Patricia, then Patricia is the ____ of Ruby’s mother.

Last Week’s Riddle: A father tells his young son, “I will pay you $6.00 per hour for the 6 seconds you took to wash your hands before dinner.” So, how much does the boy earn for these 6 seconds of effort?

Answer: One cent. At a rate of $6 paid per 60 minutes, $6 divided by 60 works out to 10 cents a minute. Six seconds is one-tenth of a minute, so the boy earns 1 cent.

The Twelve Apostles, Great Ocean Road, Victoria, Australia

Victoria, Australia

Footnotes and Sources

1. WSJ.com, October 17, 2025

2. Investing.com, October 17, 2025

3. CNBC.com, October 13, 2025

4. CNBC.com, October 14, 2025

5. WSJ.com, October 15, 2025

6. CNBC.com, October 16, 2025

7. CNBC.com, October 17, 2025

8. WSJ.com, October 17, 2025

9. IRS.gov, May 30, 2025

10. Healthline, June 11, 2025