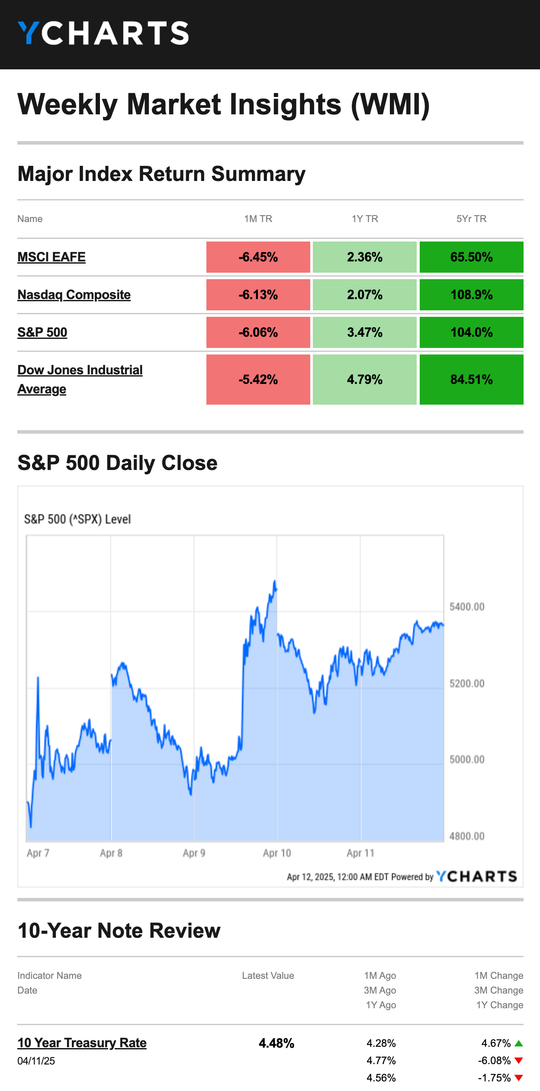

Stocks ended the week with a strong gain as traders continued to focus on tariff talks while appearing to overlook upbeat news on inflation.

The Standard & Poor’s 500 Index rose 5.70 percent, while the Nasdaq Composite Index gained 7.29 percent. The Dow Jones Industrial Average picked up 4.95 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, increased by 0.72 percent.1,2

Stocks Rebound

Stocks rallied on Monday after a report surfaced that the administration was considering a 90-day pause on tariffs. But when the White House clarified its position, sellers stepped in.

On Tuesday, prices jumped at the next opening bell after the Treasury Secretary said the U.S. was open to tariff negotiations with trading partners. The rally stalled and reversed on news the administration was adjusting tariffs on Chinese imports.3

After the White House announced a 90-day pause on specific tariffs on Wednesday, markets pushed higher. The S&P 500 gained 9.5 percent, its largest one-day increase in 17 years.4

Stocks fell again Thursday morning, appearing to overlook an upbeat Consumer Price Index report showing that core inflation (excluding food and energy) rose at a 2.8 percent annual rate–the best number in more than four years. Stocks finished the week with a powerful rally, capping a volatile trading week.5,6

Source: YCharts.com, April 12, 2025. Weekly performance is measured from Monday, April 7, to Friday, April 11. TR = total return for the index, which includes any dividends as well as any other cash distributions during the period. Treasury note yield is expressed in basis points.

Due to a data transmission issue, year-to-date performance figures were not available this week.

Watching the Bond Market

The yield on the 10-year Treasury rose more than 50 basis points for the week, marking one of the most significant moves on record. (When bond yields increase, bond prices tend to move lower.)

The week’s action was unexpected. In the past, investors have turned to U.S. bonds during market turbulence. However, the ongoing tariff talks have, at least temporarily, influenced how some overseas investors view U.S. bonds.7,8

The bond market activity influenced the mortgage market, where the average rate on the popular 30-year fixed mortgage closed Friday at 7.1 percent, its highest level in two months.9

This Week: Key Economic Data

Monday: Philadelphia Fed President Patrick Harker and Atlanta Fed President Bostic speak.

Tuesday: Import Price Index.

Wednesday: Retail Sales. Industrial Production. Business Inventories. Home Builder Confidence Index. Cleveland Fed President Hammack speaks.

Thursday: Housing Starts. Building Permits.

Friday: San Francisco Fed President Mary Daly speaks.

Source: Investors Business Daily – Econoday economic calendar; April 11, 2025

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

ts of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Monday: The Goldman Sachs Group, Inc. (GS)

Tuesday: Johnson & Johnson (JNJ), Bank of America Corporation (BAC), Citigroup Inc. (C)

Wednesday: Abbott Laboratories (ABT), Prologis, Inc. (PLD)

Thursday: UnitedHealth Group Incorporated (UNH), Netflix, Inc. (NFLX), American Express Company (AXP), Marsh & McLennan Companies, Inc. (MMC), The Blackstone Group (BX), Infosys (INFY)

Source: Zacks, April 11, 2025. Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

“I think that we communicate only too well, in our silence, in what is unsaid, and that what takes place is a continual evasion, desperate rear-guard attempts to keep ourselves to ourselves. Communication is too alarming.”

– Harold Pinter

Tax Tips for Farmers

If you own a farm, ranch, range, or orchard, here are some tax tips to consider:

- Insurance payments from crop damage may count as income. Check with your tax professional.

- If you sold livestock or items you bought for resale, you may have a taxable event.

- You may be able to deduct ordinary and necessary expenses that you paid for your business.

- Consider the tax treatment of your farm’s full and part-time workers.

- If your expenses are more than your income for the year, you may have a net operating loss. You may be able to carry that loss over to other years.

This information is not a substitute for individualized tax advice. Please discuss your specific tax issues with a qualified tax professional.

How to Measure Your Heart Rate (Without a Smart Device)

There are so many smart gadgets to help us monitor our health, but knowing how to measure your heart rate without any tech is important to monitor your overall health.

- To measure your heart rate, gently place your index and middle finger on a pulse point, such as your wrist right below the base of your thumb or your neck right under your jawbone.

- Lightly press until you can feel your heartbeat, then count the number of beats in 15 seconds. You’ll need a watch or clock to time yourself.

- Multiply this number by 4 to get your heart rate per minute.

- Feel free to repeat this exercise a few times to confirm your reading’s accuracy.

Tip adapted from Harvard Medical School11

I have a horn and am almost as large as a car, but I will never honk my horn or outrun a car or truck. What might I be?

Last week’s riddle: I can certainly run, but I will never be able to walk by myself. Wherever I go, thoughts are close behind me. What am I?

Answer: A nose.

Scenic Highway 93

Alberta, Canada

Footnotes and Sources

1. The Wall Street Journal, April 11, 2025

2. Investing.com, April 11, 2025

3. CNBC.com, April 8, 2025

4. The Wall Street Journal, April 9, 2025

5. The Wall Street Journal, April 10, 2025

6. MarketWatch.com, April 11, 2025

7. WSJ.com, April 9, 2025

8. MarketWatch.com, April 9, 2025

9. CNBC.com, April 11, 2025

10. IRS.gov, June 4, 2024

11. Harvard Medical School, December 12, 2024