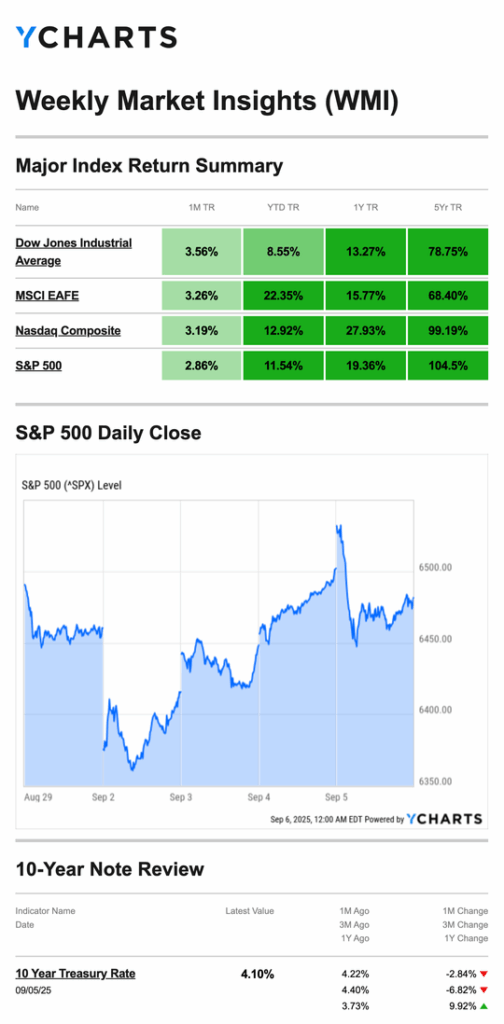

Stocks made gains last week, even as megacap tech gains outweighed economic concerns.

The Standard & Poor’s 500 Index advanced 0.33 percent, while the Nasdaq Composite Index rose 1.14 percent. The Dow Jones Industrial Average descended 0.32 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, gained 0.04 percent.1,2

Tech Gains, Jobs Slow

Markets started the week on shaky ground. The Dow Industrials, S&P 500, and Nasdaq each slipped downward more than half a percentage point. Tariff uncertainty rose again, as a court ruling injected fresh doubt. Meanwhile, rising Treasury yields amplified volatility and rattled megacap tech names.3

By Tuesday, stocks managed a partial rebound, and market direction shifted. Tech bounced back the next morning—led by two megacap tech stocks’ gains—with one soaring after avoiding an antitrust penalty.4

On Thursday, softer private hiring data and rising layoff trends fueled hopes of an imminent Fed rate move, with the S&P hitting a fresh record close. Treasury yields dropped significantly on rate-cut speculation, reinforcing risk appetite. The mood shifted again on Friday. A surprisingly weak jobs report undercut market optimism.5,6

Source: YCharts.com, September 6, 2025. Weekly performance is measured from Friday, August 29, to Friday, September 5. TR = total return for the index, which includes any dividends as well as any other cash distributions during the period. Treasury note yield is expressed in basis points.

Focus on Jobs

Friday’s employment report fell short, as employers created fewer jobs last month.

Unemployment increased to 4.3 percent in August from 4.2 percent the prior month, hitting a 4-year high. Job growth slowed to 22,000 jobs in August, after much higher expectations of 75,000. In addition, a revision of the June estimate decreased the number by 27,000 jobs.7

This Week: Key Economic Data

Monday: Consumer Credit.

Tuesday: NFIB Small Business Optimism Index.

Wednesday: Producer Price Index (PPI). Wholesale Inventories.

Thursday: Consumer Price Index (CPI). Weekly Jobless Claims. Federal Budget.

Friday: Consumer Sentiment.

Source: Investors Business Daily – Econoday economic calendar; September 5, 2025

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Tuesday: Oracle Corporation (ORCL)

Thursday: Adobe Inc. (ADBE)

Source: Zacks, September 5, 2025. Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

“Challenging power structures from the inside, working the cracks within the system, however, requires learning to speak multiple languages of power convincingly.”

– Patricia Hill Collins

Learn About Backup Withholding

Backup withholding is when a taxpayer must withhold at the current rate of 24%, taken from any future payments, to help the IRS receive the tax due on this income; this can happen for many reasons, including failing to provide a correct taxpayer identification number (TIN) or failing to report or underreport interest and dividend income.

Many types of payments are subject to backup withholding, and you can view the complete list on the IRS’ website, but some include:

- Interest payments

- Dividends

- Rents, profits, or other gains

- Commissions, fees, or other payments for work you do as an independent contractor

- Royalty payments

This information is not a substitute for individualized tax advice. Please discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS8

Easy Houseplants That Anyone Can Grow

Houseplants can bring joy and nature to every corner of your home. Even if you don’t consider yourself someone with a green thumb, this list of easy houseplants can help get you started. They are low-maintenance. Perfect for those of us who have killed a few too many plants in the past! Here are some of the easiest houseplants that anyone can grow:

- Monstera

- Sansevieria a.k.a. snake plant

- ZZ plant

- Spider plant

- Heart-leafed philodendron

- Dracaena

- Ponytail palm

- Pothos

Most of these plants are easy to care for because they tolerate watering and light conditions. Some are fine in indirect or low-light situations, while some prefer a sunny corner. Research each one to see which ones will fit into your home.

Tip adapted from Bloomscape9

A lone pine tree stands on a cliff. The wind is blowing from the east through the mountains. Which way do the tree’s leaves blow?

Last Week’s Riddle: It has no crown, yet when the chips are down, it is more powerful than a king or queen. What is it?

Answer: An ace in a deck of cards.

Hagia Sophia

Istanbul, Turkey

Footnotes and Sources

1. WSJ.com, September 5, 2025

2. Investing.com, September 5, 2025

3. CNBC.com, September 2, 2025

4. CNBC.com, September 3, 2025

5. CNBC.com, September 4, 2025

6. WSJ.com, September 5, 2025

7. MarketWatch.com, September 5, 2025

8. IRS.gov, October 8, 2024

9. Bloomscape, March 20, 2025