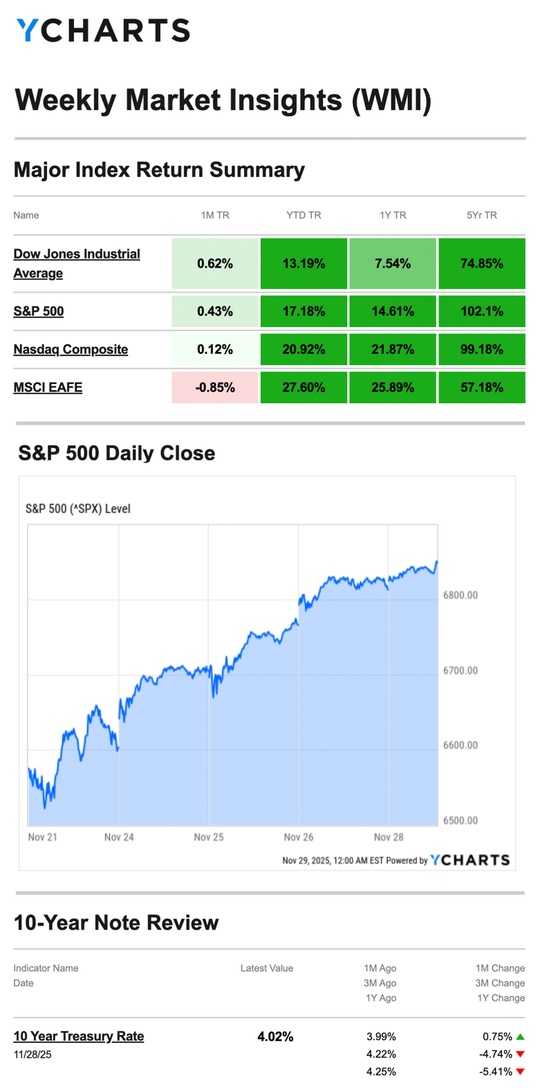

Stocks pushed higher over the holiday week as investors’ hopes for a Fed rate adjustment drove bullish sentiment.

The Standard & Poor’s 500 Index rose 3.73 percent, while the Nasdaq Composite Index rallied 4.91 percent. The Dow Jones Industrial Average advanced 3.18 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, increased 3.15 percent.1,2

AI Powered

A rebound rally began on Monday as the artificial intelligence (AI) business strategy of one of the largest megacap tech stocks reignited positive sentiment in the AI trade. The enthusiasm broadened out to a number of AI-related names, lifting the S&P 500 by 1.5 percent and the Nasdaq by 2.7 percent—its biggest one-day gain in more than six months.3

Stocks rose again on Tuesday and Wednesday—the third and fourth consecutive trading days of gains, respectively, for all three major averages.

Overall bullish holiday sentiment, positive news on a handful of AI-related megacap tech names, and continued investor optimism for the Fed to adjust rates at its next meeting powered the advances.

Markets continued their rise after the Thanksgiving holiday, with stocks rounding out the shortened trading session with a fifth consecutive day of gains.4,5

Source: YCharts.com, November 29, 2025. Weekly performance is measured from Friday, November 21, to Friday, November 28. TR = total return for the index, which includes any dividends as well as any other cash distributions during the period. Treasury note yield is expressed in basis points.

Keeping Score on the Consumer

As we move full steam ahead into the holiday shopping season, investors are closely watching consumer data.

The fresh consumer spending data released last week was the first update. The delayed report showed the pace of retail sales in September cooled slightly over the prior month, just shy of expectations.

Next up was the Conference Board’s November survey, which showed that consumer confidence dropped to 88.7 from 99.5 in October.6

Investors may be anxiously awaiting the October retail sales report and closely monitoring other consumer data points for clues about the future direction of the economy.

This Week: Key Economic Data

Monday: PMI Manufacturing Index. ISM Manufacturing.

Tuesday: Auto Sales.

Wednesday: ADP Employment Report. Import Prices (Sept.)* PMI Services Index. ISM Services.

Thursday: Weekly Jobless Claims. Trade Deficit (Oct.)

Friday: Personal Consumption Expenditures (PCE) Price Index (Sept.)*

* indicates publication of a report that had been delayed by the government shutdown

Source: Investors Business Daily – Econoday economic calendar; November 28, 2025. The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Tuesday: CrowdStrike (CRWD), Marvell Technology, Inc. (MRVL)

Wednesday: Salesforce Inc. (CRM), Snowflake Inc. (SNOW)

Thursday: The Kroger Co. (KR)

Source: Zacks, November 28, 2025. Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

“He who is not courageous enough to take risks will accomplish nothing in life.”

– Muhammad Ali

Be Vigilant & Protect Yourself From Texting Scams

Unfortunately, instances of IRS-themed text scams are on the rise, and these scam attempts could put your sensitive tax data at risk. Most of these scam messages look like they’re coming from the IRS and have fake messages to lure you into providing personal information. They may also ask for your information to help you set up an IRS account online.

Be aware of these scams to protect yourself and your data. Remember, the IRS does not send emails or texts asking for personal or financial information. If you receive a text like this, report it to the IRS by emailing phishing@irs.gov.

This information is not a substitute for individualized tax advice. Please discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS.gov7

This Virtual Experience Lets You Take a Vacation Without Leaving Home

Google Arts & Culture allows you to do many things, including exploring lands near and far without leaving your house.

The platform is constantly growing, but some of the most popular activities include hiking Machu Picchu, taking a virtual tour of the Louvre, traveling through time, or viewing hundreds of photos from almost any location worldwide. Learn more about famous works of art and experience them with augmented reality. Art Projector even lets you see how artworks look in actual size right before you. See what the Mona Lisa looks like in your living room!

The experience works on your computer, but you can also download the app to experience Google Arts & Culture on the move.

Tip adapted from Google Arts & Culture8

What word measures weight and turns negative if spelled backwards?

Last Week’s Riddle: Christine likes grapes but not potatoes. She likes squash but not lettuce, and peas but not onions. Following the same rule, will she like pumpkins or apples?

Answer: Pumpkins. Christine only likes fruits and vegetables that grow on vines.

Iguazu falls

Iguazú, Argentina

Footnotes and Sources

1. WSJ.com, November 28, 2025

2. Investing.com, November 28, 2025

3. CNBC.com, November 24, 2025

4. CNBC.com, November 26, 2025

5. CNBC.com, November 28, 2025

6. WSJ.com, November 25, 2025

7. IRS.gov, May 29, 2025

8. Google Arts & Culture, June 12, 2025